This can be difficult for businesses with a large number of items or fast-selling products. The company’s financial statements report the combined cost of all items sold as an offset to the proceeds from those sales, producing the net number referred to as gross margin (or gross profit). This is presented in the first part of the results of operations for the period on the multi-step income statement. The unsold inventory at period end is an asset to the company and is therefore included in the company’s financial statements, on the balance sheet, as shown in Figure 10.2. Specific identification works differently to the other inventory costing methods and technically isn’t a method in its own right.

What are the most common inventory costing methods?

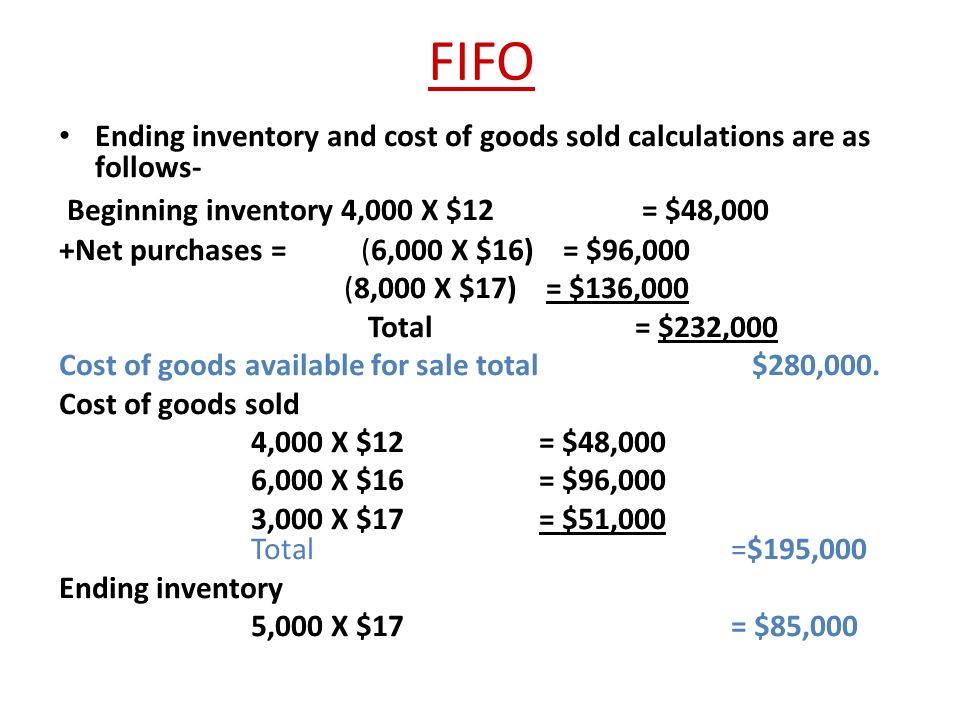

In merchandising companies, inventory is a company asset that includes beginning inventory plus purchases, which include all additions to inventory during the period. Every time the company sells products to customers, they dispose of a portion of the company’s inventory asset. Goods available for sale refers to the total cost of all inventory that the company had on hand at any time during the period, including beginning inventory and all inventory purchases. Suppose that at the end of January 31, 2018, they had 50 oil filters on hand at a cost of $7 per unit. This means that at the beginning of February, they had 50 units in inventory at a total cost of $350 (50 × $7). During the month, they purchased 20 filters at a cost of $7, for a total cost of $140 (20 × $7).

What are inventory costs?

This difference can affect a company’s financial reporting and tax obligations depending on the jurisdiction. Getting an accurate picture of your business’ inventory can be a challenge, but it’s important to do so. You need to know how much inventory you have in your business at different times, as well as product-level data about what is selling and what is stalling. It is important to recognize that GAAP is not a stagnant set of principles. Rather, it changes to reflect changes in regulations and standards employed by businesses operating in different industries throughout the economy as a whole. Changes are made regularly to what is, and what is not, a generally accepted principle of accounting.

- Let’s see the different inventory costing methods for Ariana’s Accessories in one table so you can see how the COGS, ending inventory and gross profit compares.

- Moreover, there’s the risk of inventory becoming obsolete, which can occur when you have too much unsold inventory that’s reached the end of its lifecycle.

- This method is simpler and faster than the weighted average cost method but doesn’t always provide as much accuracy in terms of COGS and ending inventory.

- Many countries don’t accept LIFO as an accounting method anymore but for those who do, it can sometimes be worth considering to lower your tax burden.

- But in general they are all dumped into one bin and pulled out when sold.

Inventory Costing Methods FAQ

Luke O’Neill writes for growing businesses in fintech, legal SaaS, and education. He owns Genuine Communications, which helps CMOs, founders, and marketing teams to build brands and attract customers. Still, it’s always important to check the exact impacts of LIFO with your accountant or tax advisor. As Freshbooks explains, you can calculate FIFO by multiplying the cost of your oldest inventory by the amount of that inventory sold. As AccountingCoach explains in the above example, the cost of goods available of $80,000 is divided by the retail amount of goods available ($100,000).

When you’re operating in an inflationary economy, the prices of goods purchased increase over time. This means net income is highest under the FIFO method because the cost of goods sold reflects the lowest prices. Meanwhile, inventory is highest under the LIFO method because the last items purchased—at the highest prices—are in inventory. LIFO is right for mid-size businesses purchasing low volumes of inventory items of a higher value that won’t expire or go obsolete quickly. Businesses selling high-value items that don’t change value quickly can use LIFO as their inventory valuation method. The only reason to use LIFO is when businesses expect inventory costs to increase over time and result in price inflation.

Weighted average

More importantly, we will explain how each 7 x appraisal cost examples quality management method can impact your business and why you would choose one over the other. Working out the value of your inventory isn’t as simple as basic addition but it doesn’t have to be complicated either. The biggest challenge is choosing the right inventory costing methods for your business and when to use them. Inventory costs directly impact financial statements, such as the balance sheet and income statement. Properly valuing inventory allows businesses to present accurate financial information to stakeholders, investors, and regulatory authorities. If your inventory levels fluctuate significantly and you make frequent purchases, the weighted average cost method may be a good choice.

Inventory costing is an accounting process that helps businesses determine the value of their inventory. Along with managing inventory, you can track costs including storage and fulfillment costs throughout your entire network. Understanding logistics costs in real time can help you make better decisions and adjust inventory levels and reorder accordingly. Additionally, geopolitical issues and other factors could also result in unexpected demand changes, which will subsequently affect your inventory costs.

Avoiding these costs could have serious implications for your business further down the line. Storage costs refer to the cost of maintaining inventory storage systems. This can include recurring costs such as rent, utility, security, and employee wages. The business then has to bear the cost of processing a refund and losing out on the sale. In many cases, you may even have to pay for replacing damaged or perished goods, which further adds to your carrying costs. LOFOis used rarely in multilayer inventory companies where inventory expenses are extremely low.

Having a real-time overview of your stock helps you make informed decisions about when to reorder materials or products and can help prevent stockouts or overstocking. You can even set reorder points to avoid the panic of running low on supplies. You might have seen the phrase average cost inventory method thrown around here and there.