While in this competitive business landscape, you can not avoid offering trade credit; you can prevent it from hurting your business’s financial stability by creating an ‘Allowance for Doubtful Accounts”. Doubtful debt is money you predict will turn into bad debt, but there’s still a chance you will receive the money. By a miracle, it turns out the company ended up being rewarded a portion of their outstanding receivable balance they’d written off as part of the bankruptcy proceedings. Of the $50,000 balance that was written off, the company is notified that they will receive $35,000. If the company’s Accounts Receivable amounts to $3,400 and its Allowance for Bad Debts is $100, then the Accounts Receivable shall be presented in the balance sheet at $3,300 – the net realizable value.

Control Cycles in Financial Management and Accounting Systems

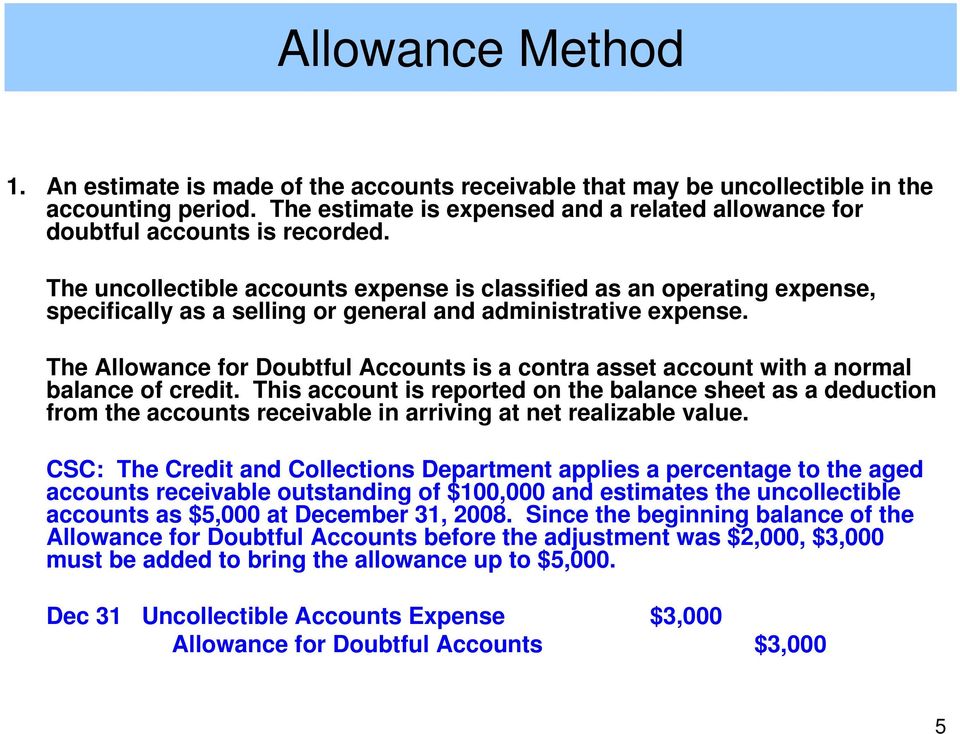

Estimating doubtful accounts is a nuanced process that requires a blend of historical data analysis, current economic insights, and industry-specific knowledge. This technique involves applying a predetermined percentage to the total credit sales of a period to estimate the allowance for doubtful accounts. The percentage is typically based on historical data, reflecting the proportion of sales that have historically turned into bad debts. This method is particularly useful for businesses with consistent sales patterns and stable customer bases. The allowance for doubtful accounts, aka bad debt reserves, is recorded as a contra asset account under the accounts receivable account on a company’s balance sheet. It’s a contra asset because it’s either valued at zero or has a credit balance.

- Here’s a breakdown of the two primary methods and some additional strategies used by businesses for ADA formula and calculation.

- By analyzing such benchmarks, businesses can make informed decisions about their approach to managing their accounts receivable and avoiding potential financial losses.

- The allowance for doubtful accounts is recorded as a contra asset account under the accounts receivable on a company’s balance sheet.

- The longer the time passes with a receivable unpaid, the lower the probability that it will get collected.

- At the end of an accounting period, the Allowance for Doubtful Accounts reduces the Accounts Receivable to produce Net Accounts Receivable.

Stay up to date on the latest accounting tips and training

As a result, the estimated allowance for doubtful accounts for the high-risk group is $25,000 ($500,000 x 5%), while it’s $15,000 ($1,500,000 x 1%) for the low-risk group. is allowance for doubtful accounts a permanent account Thus, the total allowance for doubtful accounts is $40,000 ($25,000 + $15,000). Estimating the allowance requires judgment and analysis, which can lead to inaccuracies.

Allowance for Doubtful Accounts: Methods of Accounting for

You may notice that all three methods use the same accounts for the adjusting entry; only the method changes the financial outcome. Also note that it is a requirement that the estimation method be disclosed in the notes of financial statements so stakeholders can make informed decisions. The following table reflects how the relationship would be reflected in the current (short-term) section of the company’s Balance Sheet.

With QuickBooks accounting software, you can access important insights, like your allowance for doubtful accounts. Bad Debts Expense is an income statement account while the latter is a balance sheet account. Bad Debts Expense represents the uncollectible amount for credit sales made during the period. Allowance for Bad Debts, on the other hand, is the uncollectible portion of the entire Accounts Receivable. The understanding is that the couple will make payments each month toward the principal borrowed, plus interest. With accounting software like QuickBooks, you can access important insights, including your allowance for doubtful accounts.

Specific identification method

Your accounting books should reflect how much money you have at your business. If you use double-entry accounting, you also record the amount of money customers owe you. An accurate estimate of the allowance for bad debt is necessary to determine the actual value of accounts receivable. Therefore, generally accepted accounting principles (GAAP) dictate that the allowance must be established in the same accounting period as the sale, but can be based on an anticipated or estimated figure. The allowance can accumulate across accounting periods and may be adjusted based on the balance in the account.

To do this, a company should go back five years, and figure out for every year the percentage of unpaid accounts. They can do this by looking at the total sales amounts for each year, and total unpaid invoices. Contra assets are still recorded along with other assets, though their natural balance is opposite of assets.

Older receivables are generally considered more likely to become uncollectible. By segmenting receivables into different age brackets, businesses can apply varying percentages of estimated uncollectibility, providing a more nuanced and accurate allowance. Ideally, you’d want 100% of your invoices paid, but unfortunately, it doesn’t always work out that way. The Pareto analysis method relies on the Pareto principle, which states that 20% of the customers cause 80% of the payment problems. By analyzing each customer’s payment history, businesses allocate an appropriate risk score—categorizing each customer into a high-risk or low-risk group.